The chroniclers of the crypto collapse

A review of *Easy Money,* *Number Go Up* and *Going Infinite*

Sometimes you set out to write a book. You get deep into the research. You know the shape of it. You also have a contract with a press, an editor waiting for pages. And then events unfold. Like, y’know, the blockchain bubble economy of 2022 spirals out of control. Or an unqualified authoritarian demagogue is elected to the Presidency.

As a writer, you’re faced with a decision. Do you: (1) gut-renovate the book, following those events in an unexpected direction, or (2) barrel forward, staying true to your original vision?

William Gibson offers a useful example. In 2017, after Trump’s election, Gibson scrapped the sequel he had been writing to The Peripheral. The Peripheral occurs across two time periods — an easily recognizable dystopian near-future and a barely recognizable far-future, created in the aftermath of a multicausal slow-motion apocalypse that Gibson calls “The Jackpot.”

Gibson decided he had to rewrite the book. The near-future dystopia he had in mind couldn’t keep up with current events. As he told The New Yorker, his writing process begins with “a sort of deep reading of the fuckedness quotient of the day. I then have to adjust my fiction in relation to how fucked and how far out the present actually is.” And Trump’s election sent him scrambling to reorient his settings. “…how scary can my scenario be? [Trump] keeps topping me, but I think I can handle it in rewrite. And if there’s a nuclear war, at least I won’t have to turn in the manuscript!…”

The resulting sequel, Agency, came out three years later, in January 2020. (It was, incidentally, the last book I purchased in a physical bookstore before the pandemic lockdown.) Agency is an excellent book. Readers were rewarded for the extra time Gibson took. I wonder sometimes, though, what the earlier version of the novel would have been.

This isn’t a review essay of Gibson’s novels though. (They’re great. Have you read them? Come on. You should read them.) This is just a preamble.

At the start of 2022, crypto-mania was at its peak. People were becoming millionaires off of Dogecoin and jpg receipts. It was a weird time, it had been going on for years, and it showed no sign of slowing down. Several writers decided to write a book about it. And then, as they chronicled the boom, events unfolded. Terra/Luna. 3AC. FTX.

I read three of the resulting books this year — Ben McKenzie (with Jacob Silverman)'s Easy Money, Zeke Faux’s Number Go Up, and Michael Lewis’s Going Infinite. In some ways, I think the defining feature of each book is how the author(s) adjusted to the sudden change of fortunes among the blockchain billionaire class.

Easy Money is not at all the book I was expecting from the McKenzie and Silverman. When they sold the book to Abrams Press in February 2022, they were aiming to reveal the fraud at the heart of the crypto economy. The two make for an odd pairing — McKenzie is best-known for his tv stardom (The O.C., Gotham), while Silverman earned his bona fides as a progressive, tech-critical journalist — but they proved their mettle with several hard-hitting pieces revealing the ludicrous excesses and invisible victims of the crypto bubble. (Seriously. Read the El Salvador piece they wrote for The Intercept.) They were aiming to bring down Tether, the cryptocurrency stablecoin seemingly built entirely out of red flags. I was pumped for a booklength version of their reporting.

By the end of 2022, Tether (against all odds) was still standing strong amidst the rubble of FTX, Terra/Luna, Celsius, Three Arrows Capital, etc. And, more importantly, the verb tense of the crypto boom changed. We no longer needed a book to expose the rot at the heart of the crypto economy. The bubble had burst. The marks had been fleeced, the bankruptcies declared, the lawsuits filed.

So Easy Money turned into a different book. It’s written instead entirely in McKenzie’s voice. (As a longtime Silverman fan, I found this reasonable-but-unfortunate.) And it’s basically a behind-the-scenes retelling of what he, a former teen heartthrob, saw and realized while chasing down all these crypto stories with Silverman.

McKenzie is a clever and capable writer. He makes effective use of the tensions and lucky breaks that come from being treated as that guy from the tv show instead of a crypto-critical reporter. The stories are entertaining and drive home memorable points. Easy Money is a good book.

But I think their reporting was better. Take a look at the Kim Kardashian piece, the Tether article, the Eric Adams piece, and the aforementioned El Salvador one… They all hit hard, at a time when not nearly enough people were asking hard questions about the crypto boom. A book-length version of that reporting would have ruled. The behind-the-scenes narrative doesn’t have quite the same punch, because the opponent is no longer upright.

But it is what it is. Crypto collapsed faster than expected. The book they set out to wrote no longer fit the moment. McKenzie-centered first-person reporting narrative was the next-best book they could write, given the circumstances.

Zeke Faux is an investigative reporter at Bloomberg News. He covers sophisticated financial crimes. In the first chapter of his book, Number Go Up, he explains why he initially avoided the crypto beat:

“Crypto didn’t hold the same appeal for me. I’d resisted the topic whenever it came up at work. It seemed so obvious. The coins were transparently useless, and people were buying them anyway. A journalist composing a painstaking exposé of a crypto scam seemed like a restaurant critic writing a takedown of Taco Bell.”

That’s great imagery, and a clue why Number Go Up is on so many “book of the year” lists. Faux, like McKenzie and Silverman, pursues Tether as the most-likely-fraud-domino-to-fall. He visits with many of the same wild and unlikely characters (including SBF, before and after the downfall), and documents many of the same excesses and victims. Both books are fun and funny. I would read either one at the beach.

But Faux has written the definitive book on the topic. In a decade, when I’m trying to explain Dogecoin and the NFT craze to confused undergrads, this is the book I’ll have them read.

I think there are three main differences between Number Go Up and Easy Money.

(1) Faux writes of his initial book pitch: “in November 2021, near the mania’s peak, on the premise that crypto would soon collapse, and I’d chronicle the catastrophic fallout.” The bubble lasted longer than he expected, actually. But Number Go Up is essentially the book that he planned to write all along — not a much-needed takedown, but a character-driven tour through the aftermath. This book is going to hold up well because of the absurd excesses that he chronicles firsthand.

(2) Faux is a hell of a reporter. He’s also a well-employed reporter. The guy takes two reporting trips to Italy just in the hope of interviewing Tether’s Giancarlo Devasini. He travels to Cambodia to track down a scam/human trafficking ring. He makes multiple treks to the Bahamas. Part of what sets this book apart and makes it great is that Faux had the sort of travel budget that great reporting often requires.

(And I don’t mean to be a downer here, but… the trendlines in the journalism industry for continuing to have talented reporters who are well-budgeted and also investigate the types of stories that make rich people uncomfortable are atrocious. There will always be money for fancy opinion writers and elite stenographers <*cough* WalterIsaacson *cough*>. Number Goes Up is a reminder of the spillover benefits from having media organizations that don’t operate on shoestring budgets and journalists who aren’t forced to constantly line up their next freelance gig.)

(3) The payoff is that Zeke Faux covers a lot of terrain that McKenzie and Silverman don’t get to. The chapters on Cambodian text-fraud factories are fascinating. The chapter where he buys an NFT just so he can attend one of those absurd NFT parties is something I’m going to want to assign to my students a decade from now, so they can all bask in the glorious excesses of “how the hell were monkey JPGs ever a thing?” The denouement of his Devasini-chase is so rewarding that I don’t want to spoil it for you.

Number Go Up is an iconic book. It documents an era, in much the same way that Michael Lewis’s The New New Thing and The Big Short documented earlier eras.

Speaking of which…

There is a type of book that Michael Lewis writes. The man has written seventeen books. That’s a genre.

The difference between a Walter Isaacson book and a Michael Lewis book is that Isaacson is committed to writing “great man” tales of history, while Lewis writes “fascinating character” books. Lewis’s gift is in finding interesting, semi-obscure individuals who see something that others don’t, struggle against the perverse incentive structures of the status quo, and ultimately turn out to be ahead of the curve.

In the preface to Going Infinite, he tells the story of his first encounter with Sam Bankman-Fried. It is late 2021, the crypto boom shows no sign of abating. SBF’s exchange, FTX, is a financial rocketship. SBF is quirky and bright, cagey but insightful, baffling and charming. Lewis is sold. This is a perfect Michael Lewis main character. And so Michael Lewis commits himself to telling the story of the crypto boom through SBF.

Two problems, though:

(1) Lewis writes this as a crypto-neutral book. He isn’t going to wade into debates over whether the blockchain is the future-of-money or megatulipmania.

(2) Michael Lewis’s main characters are not frauds or scam artists. We may not like them. They may not be good people. But the companies, the products, and the money are real. (His main characters certainly are not sociopathic liars who fool even Michael Lewis himself.)

The collapse of FTX and unraveling of the entire crypto economy happened while Lewis was already deep into the reporting of the book. And he just… never really reconciles the story he set out to tell with the major events that unfolded during the telling.

Going Infinite is divided into three acts. Act I tells the story of SBF’s youth. Act II is about FTX’s meteoric rise. Act III is the fall and the aftermath. The Act I chapters (1-4) have some rough patches, but are basically fine. The Act II chapters (5-7) are vintage Michael-Lewis-style chapters. They’re kind of great. The Act III chapters are an irredeemable garbage fire. I do not know if Lewis’s gold-plated reputation will ever recover.

The thing about the early chapters is that they are filled with entertaining scenes that, in retrospect, feel like foreshadowing. There’s an early scene where SBF is discussing the Met Gala over zoom with Anna Wintour, while simultaneously playing a mobile game called Storybook Brawl. He pays little attention to the conversation, sort of agrees to fund the entire Met Gala, and also promises to attend. Later he will back out of all these commitments. Also, he loses the video game.

Lewis renders this scene as evidence of SBF’s unbridled, restless genius. (“He could often occupy two worlds at once and win in both.”) But… he isn’t winning in either of them. The simpler reading is that he’s a rich guy with impulse control issues who absolutely needs to adjust his meds.

The middle chapters of the book are full of stories where SBF makes rash, impulsive decisions that work out terribly for him. He’s a terrible manager, constantly making shit up as he goes, surrounded by partners who quit because they just can’t deal with him anymore. His one great advantage is that he combines the disciplined angle-shooting of a Wall Street quant to the crypto goldrush before any of the other Wall Street quants arrive.

There’s a scene on page 176 where people keep encouraging Sam to hire a CFO. He refuses, saying: “Some people cannot articulate a single thing the CFO is supposed to do. They’ll say ‘keep track of the money’ or ‘make projections.’ I’m like *What the fuck do you think I do all day? You think I don’t know how much money we have?” [Act III/court case spoiler alert: Sam does not know how much money they have. He’s playing Storybook Brawl instead.]

If the book had ended with Act II — if it had been released before the collapse — then it would seem outdated now, but it would be an interesting artifact of the sheer confidence these hucksters were able to successfully project while the numbers were going up. But events unfolded, and Michael Lewis refused to adjust.

FTX goes from a $40 billion empire to bankruptcy overnight. SBF insists he did nothing wrong (he got outplayed by rival crypto mogul CZ, who set off a bank run! The bookkeeping is a mess! Some of his investments are too illiquid! It was his ex-girlfriend’s fault! etc, etc) but no customer money was ever really stolen, and the phenomenally profitable company he built would surely still be phenomenally profitable if he could just get back on his feet…

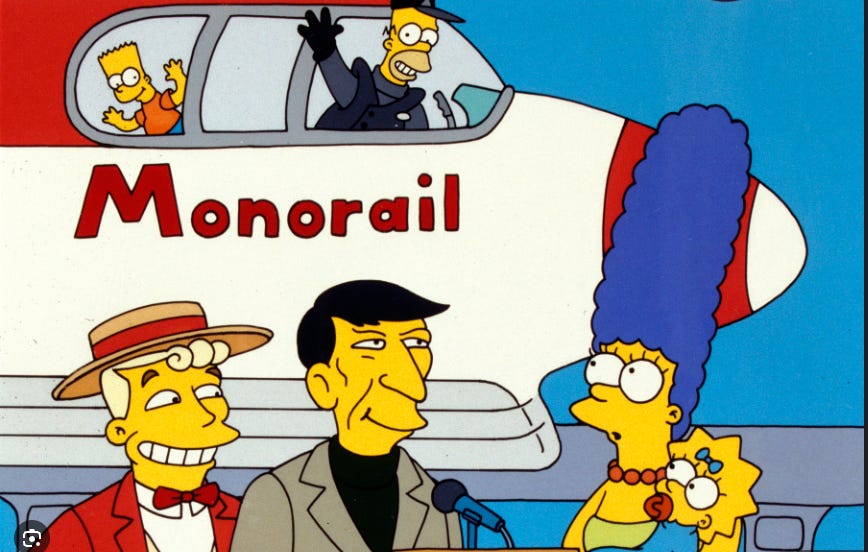

This is the moment where Lewis can no longer sustain a crypto-neutral story. One can write a crypto-neutral story when we are in the midst of an unlikely-but-long-running crypto boom (One shouldn’t, but one certainly can). One cannot stay neutral on crypto after the crash, though. That would be like writing a biography of Lyle Lanley (the monorail salesman in The Simpsons) while staying neutral on the underlying economics of the Monorail business.

Nowhere in Act III does Lewis consider the possibility that the entire crypto economy, including FTX itself, was built atop heaps of fraud. He believes FTX’s exchange was a wonderful, profitable business, because it collected fees on so many trades during the 2020-22 crypto boom. But how much of that trading was wash trading, meant to falsely inflate the value of the asset class? How much was backstopped by (SBF’s) Alameda? How much of the retail trading was being driven by the crypto-frenzy that SBF was desperately trying to keep well-stoked? It’s like running a Dutch tulip market and saying “well sure the tulips might be overvalued, but the market must be a solid business because look at all this trading!”

(Oh, and also, your own firm was the “market maker” driving a ton of that trading activity. So as soon as the prices decline, you will be on the hook without enough money to cover your bets. Ah well, nevertheless.)

The last two chapters feature Lewis desperately trying to piece together how it all went wrong. He still has unfettered access to SBF. John Ray, who has been brought on as CEO to guide FTX through bankruptcy proceedings, refuses to talk to SBF. He decides that he knows people, and thinks SBF is, fundamentally, a crook. So Lewis decides that Ray is a villain, and only Lewis himself is positioned to solve this great accounting mystery.

The trouble is (1) SBF is a gifted liar, (2) SBF is lying to Lewis, (2) Lewis somehow never realizes that SBF might be lying to him, and (3) he thinks he can produce the real story of FTX without bothering with the rot at the heart of the crypto collapse.

Lewis eventually concludes that none of FTX’s money was actually missing — it was just hard to track down because of all those awful people who didn’t trust Sam Bankman-Fried to help them locate it. He places blame on everyone but SBF, his central character, his quirky financial genius.

The book has immediately aged like curdled milk. Lewis spent the entire SBF trial insisting that everyone (including SBF’s defense attorneys!) had the story wrong. SBF’s lieutenants all took the stand and said “here are all the crimes we did. Here is the documentation of all the times Sam told us to lie about the crimes. And yes, he was playing Storybook Brawl the whole damn time.” Lewis, somehow, remained certain that what he saw and heard from Sam was the real story.

It’s a shame, because the first two-thirds of the book could have been reconfigured into an interesting and timely narrative. SBF’s one great trick was combining quant trading with the crypto bubble. The sheer velocity of this trick — the fact that it made him a multi-billionaire who toyed with buying his own island nation — is a cautionary tale about modern finance. There are so many flashing red lights throughout SBF’s rise. How did he manage to keep the ruse going as long as he did, fooling even the author himself?

But that would not have been a Michael-Lewis sort of book. And it seems Lewis had put too much into the project to scrap it entirely.

Every writer faces a choice when history veers in an unexpected direction. McKenzie and Silverman altered their book by adjusting the approach. Faux dove right in and surveyed the wreckage. Lewis carried on as though none of his operating assumptions had been challenged.

Lewis chose the easy path. It resulted in a book that, if he’s fortunate, will eventually be forgotten.

OK, so the thing about Going Infinite is that it might differ in degree from other Lewis books, but it does not differ in kind. Lewis is a very gifted story teller (and not just when writing; he is also a very entertaining speaker), but he is not a historian, he is not an economist, he is not a political analyst, he is not actually a journalist, and you should never, ever mistake him for any of those things.

The Big Short is an excellent case in point. Lewis presents Michael Burry as an "interesting, semi-obscure individual who sees something that others don’t, struggles against the perverse incentive structures of the status quo, and ultimately turns out to be ahead of the curve". The only problems are that:

1) Michael Burry was not an unusual individual.

2) He did not struggle against the perverse incentive structures of the system, but rather was a vital component of those incentive structures.

3) See 1). He was not ahead of the curve; the curve was made of Michael Burrys.

The reason we had sensational stories like immigrant strawberry pickers getting subprime mortgages was that there was not enough raw material for CDOs to meet the demand. But it wasn't practical to meet that demand with ever dodgier borrowers; instead, the solution was the "synthetic" CDO. The assets of a synthetic CDO weren't subprime mortgages, they were credit default swaps on mortgage bonds. Sound familiar? Burry was making his bets by supporting the creation of CDOs. You should know that synthetic CDOs accounted for about 2/3 of all the problem CDOs. It' the "side bet" scene in the movie, except that Burry was the side bettor, and the action on the side was twice as big as the "real" action.

Now sure, Burry didn't do anything immoral or illegal, the way SDF did. But the fact is that millions of people would have been able to keep their homes, their jobs, or their money had the likes of Burry never existed. Doesn't make for such a good story though, huh?

Michael Lewis is apparently aware of the self-inflicted damage generated by his unwavering support of SBF and his attacks on Caroline Ellison. It looks like he's set out a reputation laundering campaign. Lewis was recently on the 'Freakonomics' podcast where Stephen Dubner did an excellent job of carrying water for him to toss on the blazing fire of his celebrity status. Didn't work. Hubris burns pretty fast.