You’ve heard the old joke about the two hikers in bear country, right?

These two dudes are hiking together. They’re deep in the backwoods. One of them gets a little nervous. What if they run into a black bear or something? The other shrugs it off. “I’m not worried,” he says, “I’m a pretty fast runner.”

The first guy doesn’t know how to respond to that. “Seriously? You think you can outrun a black bear?”

The other guy doesn’t even break stride. “Of course I can’t outrun a bear,” he replies. “But I figure I can outrun you.”

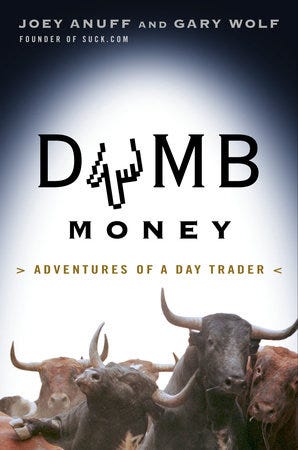

I spent last week reading a book by Joey Anuff and Gary Wolf, Dumb Money: Adventures of a Day Trader. It came out in April 2000, chronicling what life was like for day traders during the peak of the dotcom boom.

It’s a fun read. Holds up surprisingly well.

Also, last night I watched the new movie, Dumb Money, about WallStreetBets and the GameStop short squeeze. It’s based on Ben Mezrich’s book, published in September 2021 under the title “The Antisocial Network.” His book has now been rereleased as “Dumb Money: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders that Brought Wall Street To Its Knees.”

Seems like every generation has its “We’re democratizing finance, and we’re all gonna be rich!” moment. And I guess that moment always gets memorialized in a book with the same title. Go figure.

(I wonder how Anuff and Wolf feel about that. …Kinda disrespectful, y’know?)

Of course it’s great for my purposes. One of the themes I’ve been working on in the book is the parallel between the excesses and absurdities of the late ‘90s dotcom boom and the early ‘20s boom. And here I have two texts with the same title, covering the same themes, but one is referencing the internet revolution of the 1990s, the other the internet revolution of the 2020s. (The Digital Revolution, after all, permanently exists in a state of near-arrival).

(Below I’ll be comparing Anuff and Wolf’s book to the movie, rather than to Mezrich’s book. I’ll get around to reading Mezrich eventually. There’s a lot on my plate right now.)

What immediately stands out is that, before there was a WallStreetBets subreddit, there was Yahoo Finance. Before there was the RobinHood app, there was E*Trade. We’ve lived through this story before. We kind of know how it goes.

The retail traders declare a financial revolution is underway. They see a cloistered elite of financial analysts/stock brokers/private equity managers. These elites are some of the richest people in the world, skimming money off of an economic system that seems increasingly rigged against the rest of us. But the internet revolution means they can’t shut the rest of us out anymore.

The financial elites are fine with this. Hell, they love it. Because, via Anuff and Wolf:

"The public is there for one reason and one reason only, (…) They are there to absorb the risk. Brokers, broker-dealers, professional traders, they are not interested in any kind of risk whatsoever. They're interested in covered profits and arbitrage.”

That’s a quote from Anthony Elgindy, “The Mad Max of Wall Street.” Elgindy was one of the big thought-leaders in the first daytrading boom. Hundreds of amateur traders hung on his every word, paying a premium for his advice on when and which stocks they should buy and sell. Elgindy, it would later turn out, had his own disinterest in market risk. He would eventually serve six years in prison for insider trading.

E*Trade and Robin Hood weren’t disrupting the financial system. They were adding liquidity into the stock-gambling market. The whole point of “democratizing finance” is to bring more money into the game.

That’s important because, as stock valuations have become unmoored from companies’ actual revenues, the stock market becomes effectively zero-sum.* To a first approximation, if one trader earns $50,000 by betting on the stock market, some other trader(s) must have lost that $50,000.

*(Technically it’s a negative-sum game, with financial service companies taking a small cut from all the activity. Gamble long enough and the house ends up with everything.)

There are a couple of key differences between Anuff and Wolf’s Dumb Money and Mezrich’s Dumb Money. As exciting as the WallStreetBets phenomenon was, I ultimately prefer Anuff and Wolf’s book.

First is that there are no heroes in Anuff and Wolf’s story. The book is told over the course of a single day in Anuff’s life as a day-trader. He has reshaped his life to fit the rhythm of the market. CNBC is his constant companion. He researches stocks online, and researches what other people think about stocks online. He tries to gauge which stocks are going to pop and which are going to drop. Anuff isn’t trying to change the world. He’s not trying to overthrow the titans of finance. He’s just some guy, tired of watching everyone else get rich while he sits on the sidelines. He would like his million dollars, please.

Second, by the end of the book, Anuff figures out that its all kind of a grift. My favorite passage in the book appears toward the end, on pages 178-9. Anuff is speaking to Robin Dayne, a professional daytrading coach:

"I wonder if some people go into day trading for the same reason that they might turn to gambling or alcohol or some other form of self-destruction," I said to Dayne, unable to resist provoking her a little."

"It's not an addiction," said Dayne, gratifyingly annoyed. "It is a business and people work very hard in it. There's no other business, positively nothing on earth that you can spend one year of training and make this amount of cash. There's nothing! Name one thing. There's nothing!"

"Um, what amount of cash are you thinking of?" I asked.

"Well, a good consistent trader makes an average of a thousand dollars per day. That's a nice living. You know you don't have to go for the big bucks. You don't have to make a million dollars a year. You can live very nicely on a thousand a day, or even five hundred a day. What jobs do you know that you can make five hundred a day and maybe work two hours? Certainly not as a magazine writer!"

"No," I admitted, "Nope." Then again, I thought to myself, I've never actually lost money on a writing assignment.

The question occurred to me, and not for the first time, that if some people were making a thousand dollars per day on short-term trades, where was the money coming from?

"Can everybody make money simultaneously?" I asked, trying to see if I lived on the same mathematical planet as Dayne did.

"Yes," Dayne said firmly. "Every day there is a new IPO." [emphasis added]

Twenty years later, “Every day there is a new IPO” will be reborn as “WAGMI” (We’re all gonna make it). It’s nonsense, of course. But it’s load-bearing nonsense. The sharp retail traders can only make $500/day if there is a pool of suckers they can profit from. The first rule of a Greater Fool economic scheme is to insist you aren’t engaged in a Greater Fool economic scheme. And while Anuff and Wolf stop short of declaring “yeah this is all a racket,” the book concludes with Anuff clocking that the promise of daytrader millions is out of a mix of hot air and other-people’s-misery.

By comparison, Mezrich’s Dumb Money (or at least the movie based on his book) is centered on a ragtag band of heroes who we can all root for. They’re the retail traders who got together on WallStreetBets. They educated themselves about the market. They found a short squeeze opportunity — the type of move that sophisticated traders can execute, but the “dumb money” can’t pull off. They persevered through the pressure, and showed real solidarity (“diamond hands!”). And they won!

The movie has clear ambitions to be the next The Big Short. It’s well-paced, funny, and has a star-studded cast. But it has a couple of shortcomings. It doesn’t really have villains, per se. Gabe Plotkin of Melvin Capital is portrayed as rich and out-of-touch, but his great sin is that he thinks GameStop’s business model of selling video games in the mall in 2021 is a dead end. (Which… I mean… yeah?)

The other limitation is that, while The Big Short was tasked with explaining (1) what the hell a credit default swap is, and (2) how they blew up the entire global financial system, Dumb Money is focused on shorts. And shorting stocks isn’t necessarily a bad or irresponsible thing.

You know who hates shorts? Like, absolutely despises them? Elon Musk. Elon Musk thinks the stock market should be a viral popularity contest. He thinks when you buy a stock, it’s because you are rooting for the company. He doesn’t think stocks should be about fundamentals, or about whether you think the company is over- or undervalued. He threw a childish tantrum at Bill Gates for shorting Tesla. It was all ridiculous and sad.

But the more significant problem with telling the story of WallStreetBets as a heroic victory is… I mean, on the grander scale, what did the GameStop short really accomplish? They made money. Some of them made a lot of money. Our villain, Gabe Plotkin had to sell off Melvin Capital. In the years since, he has started another fund and become majority owner of the Charlotte Hornets basketball team. There hasn’t been another WallStreetBets-style short squeeze in the years since. The big private equity players started paying attention to retail investor chatter. They now incorporate retail behavior into their investment strategies.

In the meantime, private equity keeps buying and ruining pretty much everything in sight. The mass behavior of retail investors didn’t upend Wall Street or scare the titans of finance. It just became another data point, factored into the algorithmic trading models that scoop out all the money from the real economy and leave otherwise-profitable enterprises to rot.

It was easy to cheer Wall Street Bets when it happened. It was awesome. Like watching a perfect game in baseball. But the thing about a perfect game in baseball is it’s still just a game. And the thing that worries me about celebrating the Wall Street Bets story as a heroic triumph is that will just lead to more retail money sloshing around the betting-on-financial products economy. And that’s good for the titans of finance, but bad for the rest of us.

The lesson to take from GameStop isn’t “haha now the financial system has been democratized and the fat cats have lost their advantage over the little guy.” That’s a catastrophically bad takeaway. The democratization of finance does not redistribute financial power. It does not disrupt the status quo. Neither Yahoo Finance in 1998 nor the Robin Hood app in 2021 were tools for tearing down the walls of the financial system. What they mostly accomplished was to dig a deeper moat.

One last passage from Anuff and Wolf comes to mind.

Joey Anuff and the Yahoo Finance crowd, circa 1999, see themselves as competing with the slow-moving suckers on E*Trade. They figure they can reliably become millionaires, because they’re more savvy than these new-arriving Greater Fools. As Anuff puts it (page 141):

"As long as there was an inside, and I wasn't in it, playing the stock market was a dangerous game. But now, as Discover never tired of point out, even rural pig farmers are on the inside, which meant there isn't an inside. It is come one, come all, the water's fine, and the devil take the hindmost. (...) The less the market resembles a private club, the less likely it is that I am the Greater Fool."

He figures out by the end of the book that the quants, the high-frequency traders, and the big institutional players are all in the same game as him. Over time (and certainly once the bubble pops), all the suckers will go broke. Yahoo Finance doesn't have an edge against the professional traders.

Which brings us back to those hikers in bear country.

In the long run, you aren’t going to beat the market. Any edge that a Robin Hood trader can find, the high frequency trading algorithms can exploit faster and better. What the late ‘90s day traders and the early '20s Robin Hood app users had going for them was a wave of even less sophisticated users that they could take advantage of, at least for awhile.

They didn’t have to outrun the titans of finance. They just had to outrun you.

This is an unstable equilibrium, though. They’re just at the top of the gambling-on-stocks economy.

And the thing about the metaphorical bear is that it keeps coming. It’s insatiable.

If you want to pick a fight with the titans of finance, you shouldn’t do it by making them stronger.

A good post and, at the risk of making subtext text, that's part of what worries me about Substack.

For Substack to feel dynamic depends on a lot of people writing for free (waves at our gracious host). There are lots of reasons why people write for free, and have done so in various platforms on the internet. But, IF people are writing for free because they think there's a good path to monetizing that later on; that path is going to get longer; there will start to be a larger divide between the professionals and casual writers.

I hope that will happen gracefully and that there will still be a culture of people supporting and encouraging each other, but I don't take that for granted. It will require people deciding that's what they want, and a fair amount of selfless energy to sustain that.

This explains a lot of the whining about index funds. Index funds have low expenses since S&P does the research and all the fund manager does is trade now and then. Index funds spread the risk. When I was a kid, the idea of a "dart board" portfolio was considered outlandish even as experiments with dart board funds outperformed more cleverly composed ones. Index funds are easy to understand. They just don't provide a good pool of suckers and generate a lot of money for brokers.

The next time you see an "Index Funds Linked to Cancer" article, remember who planted it and why.